The specialized and niche IMSI Catcher Market Size is a direct reflection of the high value and critical importance placed on this technology by a very specific set of government customers. To truly appreciate its scale, it is useful to deconstruct the market into its core components, from the types of systems sold to the geographic distribution of its exclusive clientele. The market is on a firm trajectory to reach an industry valuation of USD 0.45 billion by 2035, a figure that represents the total global spending by law enforcement and intelligence agencies on this tactical surveillance equipment. This growth is being driven by a solid 7.02% compound annual growth rate from 2025 to 2035, showcasing the steady and ongoing investment in these tools as a core component of national security.

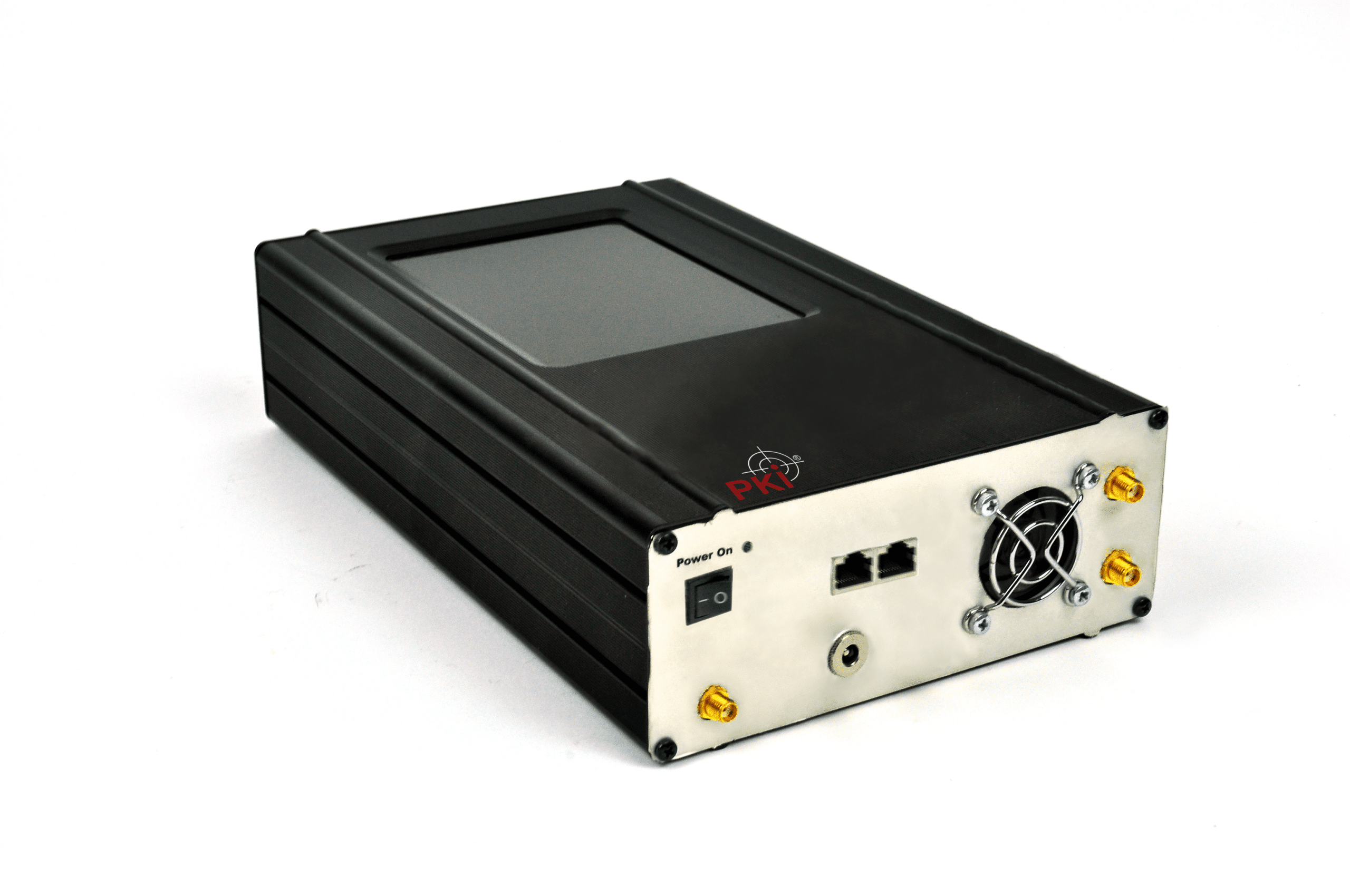

Breaking down the market size by the type of product provides insight into its operational use. The market for vehicular systems likely represents the largest segment. These powerful systems, integrated into discreet vehicles, offer a balance of wide-area coverage and tactical mobility, making them a workhorse for urban surveillance by federal and state-level law enforcement. The handheld or portable segment is another significant component, catering to the need for close-in, tactical operations, such as use by SWAT teams or for discreet placement in a fixed location. The airborne systems segment, while smaller in terms of the number of units sold, is the highest value, as these sophisticated systems for airplanes and drones are extremely expensive and are procured by national-level intelligence agencies for large-scale surveillance.

When segmented by end-user, the market size is entirely composed of government entities. The largest portion of the spending comes from national-level intelligence and security agencies, such as the NSA in the U.S. or MI6 in the U.K., who have the largest budgets and the most expansive surveillance missions. Federal law enforcement agencies, like the FBI or the DEA, are the next largest customer segment, using the technology for major criminal investigations. A smaller but growing portion of the market comes from state and local police departments, although their procurement is often more limited by budget constraints and public scrutiny. The total market size is the aggregate of the procurement budgets of all these different agencies around the world.

From a geographic perspective, the market size is heavily concentrated in a few key regions. North America, driven by the massive budgets of U.S. defense, intelligence, and federal law enforcement agencies, is by far the largest single market. Europe is the second-largest market, with significant spending by major powers like the U.K., Germany, and France. The Middle East is also a major market, with governments in the region investing heavily in internal security and surveillance technology. The market in other regions, like Asia-Pacific and Latin America, is smaller but growing as their security agencies modernize and enhance their capabilities, providing new growth opportunities for the industry.

Explore Our Latest Trending Reports: